The following videos have been created to help you analyze Excel exports of the Flat Ownership Report.

Contact [email protected] if you’d like a direct link to the AOI used to generate these sample reports.

*Surface interest has been excluded prior to exporting these reports.

Tracts generates a Flat Ownership Report that includes all interest in the AOI–this flat ownership report can be viewed on a per lease basis, which is what it defaults to within the platform.

It can also be viewed on a per-tract basis.

This article will analyze each of those versions now, as they are viewed in Excel.

Flat Ownership- Per Tract

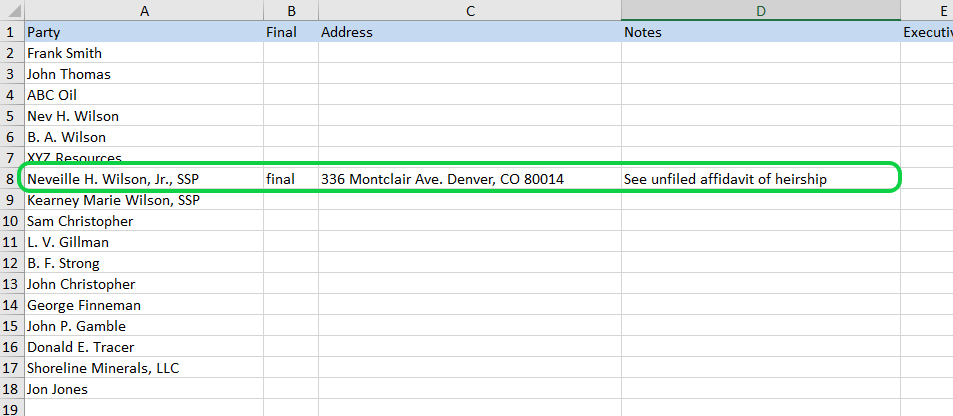

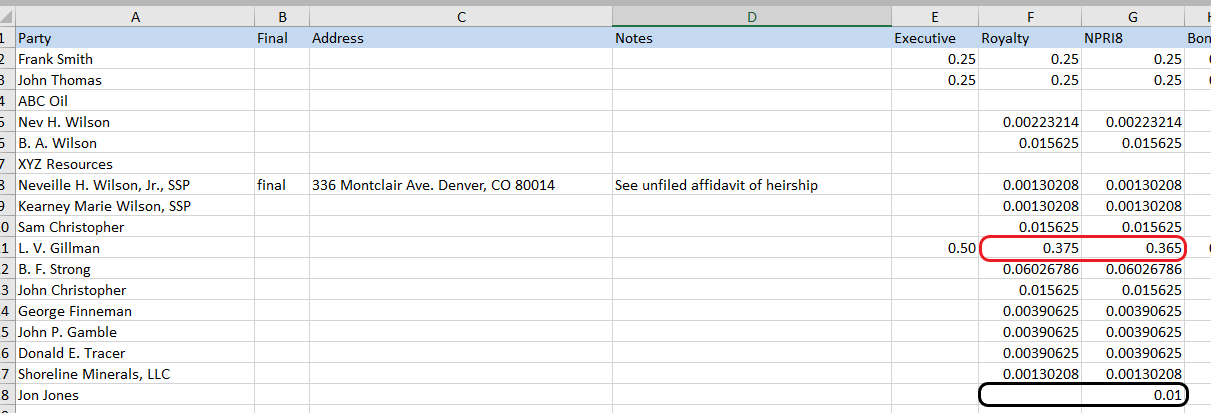

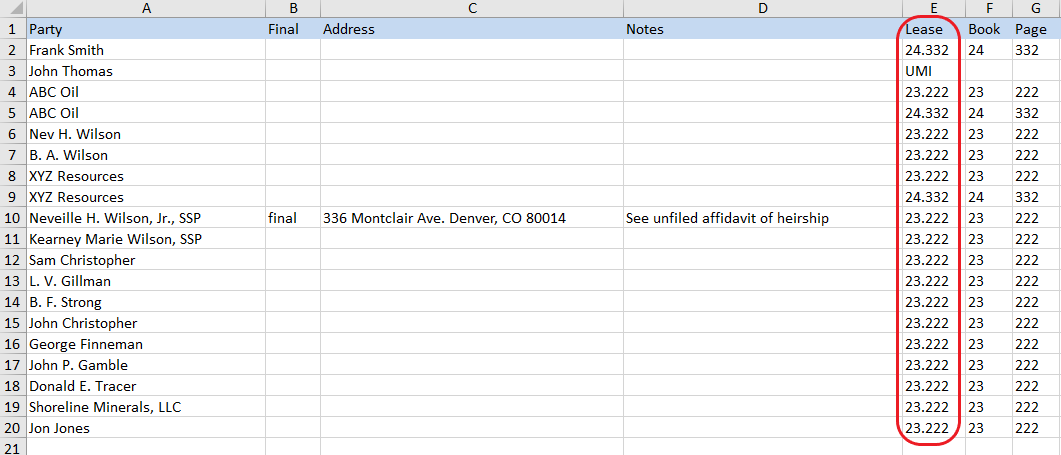

Column B will include the word “final” to indicate that the landman has fully indexed that party and is verifying their interest by this report.

Other names included were found within the landman’s research but only for the sake of determining the “final” parties’ interests.

Within Excel, this column can be easily filtered in Excel to show only “final parties.”

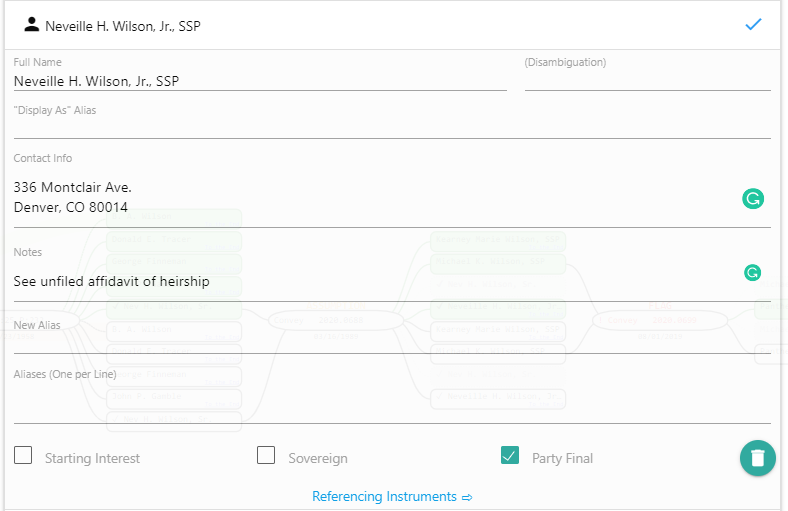

The Address and Notes columns will include addresses and notes as they are entered within the Parties & Aliases tool in Tracts.

Here’s how the above information was entered in the Parties and Aliases tool:

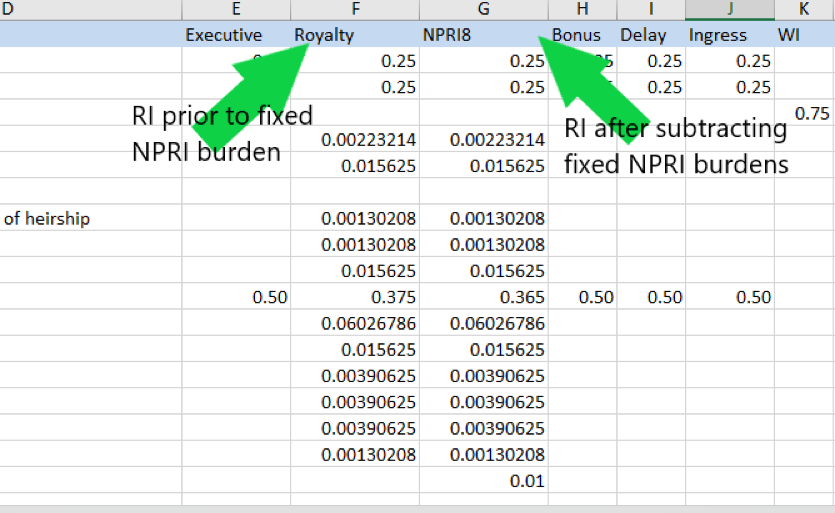

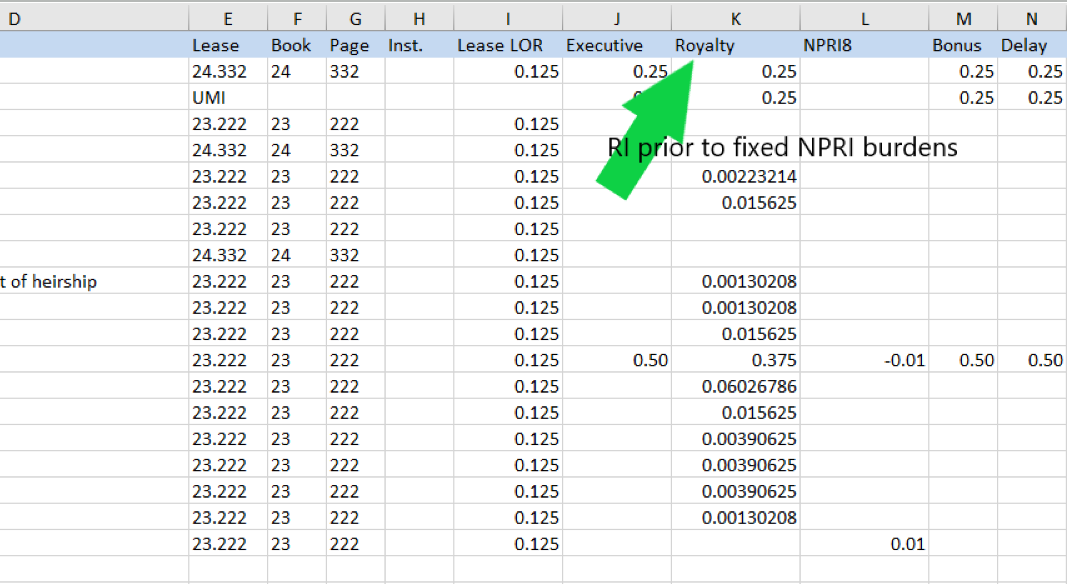

In this report, Column F shows the royalty interest of a party prior to factoring in any fixed NPRI.

Column G reflects royalty interest once fixed NPRIs are factored.

In this report, you can see that only Jon Jones and L. V. Gillman’s interests are any different in Column G than they are in Column F.

This is because L. V. Gillman conveyed a fixed 1% NPRI to Jon Jones.

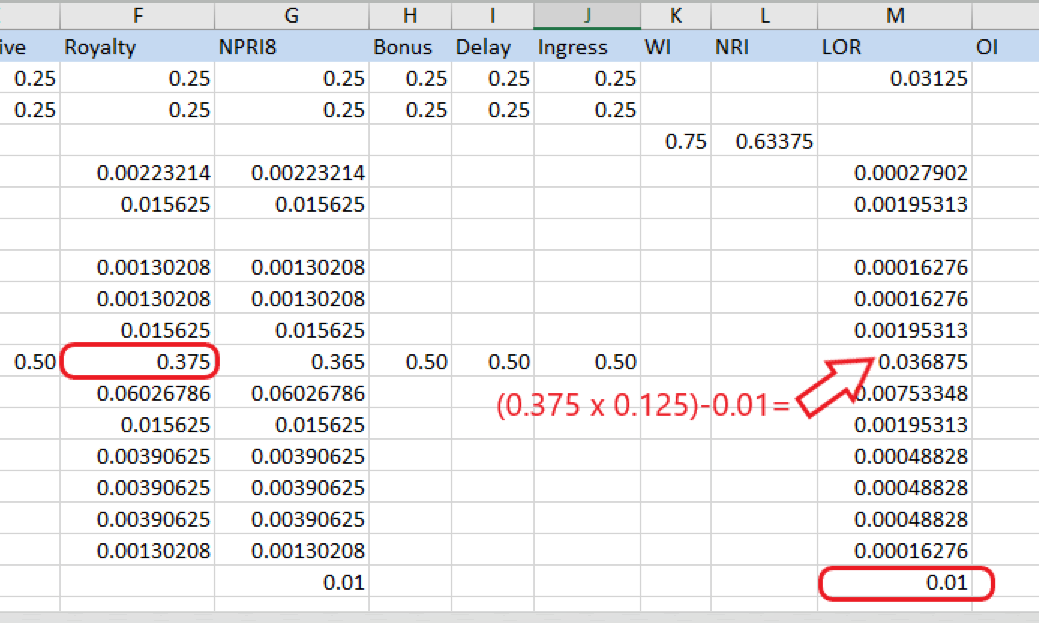

Column M (Lessor Royalty) is calculated by multiplying the royalty interest (Column F) by the lease’s royalty rate.

The only further consideration, in this case, is that the fixed 1% NPRI is subtracted from LV Gillman’s LOR and credited to Jon Jones.

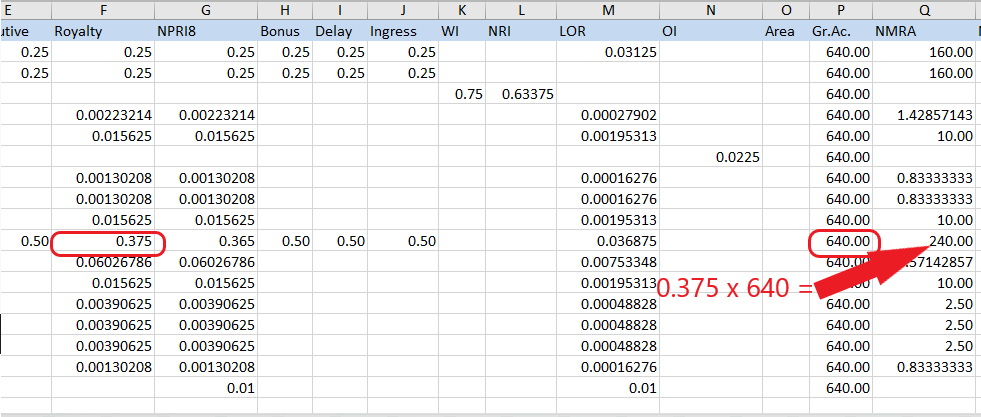

Column O identifies the sub-tract reported by each row.

- In this example, there are no sub-tracts, so the Area column is blank.

In some ways, Columns Q and R are really what we’re trying to get to from the rest of the reports. These columns provide Net Mineral Royalty Acres and Net Lease Royalty Acres.

Tracts does not assume a particular lease royalty rate to calculate NRA.

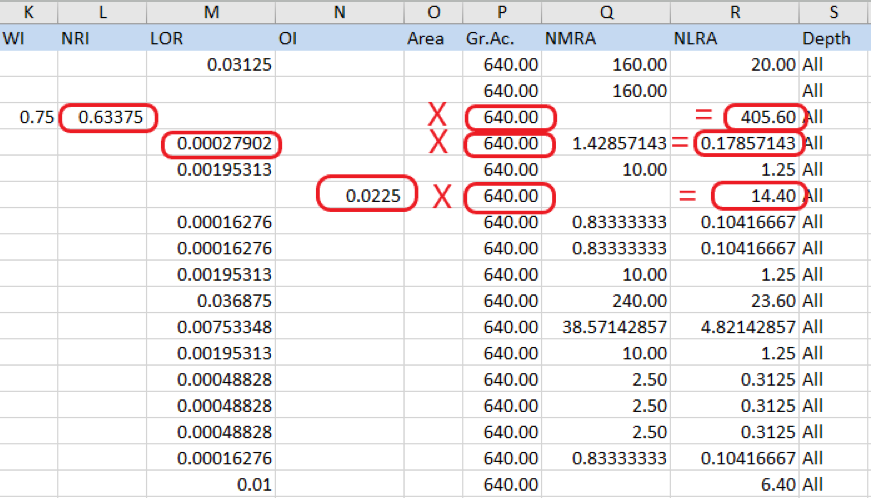

We provide Net Mineral Royalty Acres, which is equal to Royalty Interest times Gross Acreage.

And we provide Net Lease Royalty Acres, which is equal to the sum of any NRI, LOR, or OI, multiplied by Gross Acres.

Column T on this report will identify any severances in the mineral owned. This will come into play when an owner has a different interest amount in oil than in gas.

Flat Ownership- Per Lease

Column E in this report distinguishes between interests owned from each lease in the AOI.

UMI indicates an unleased mineral interest owner.

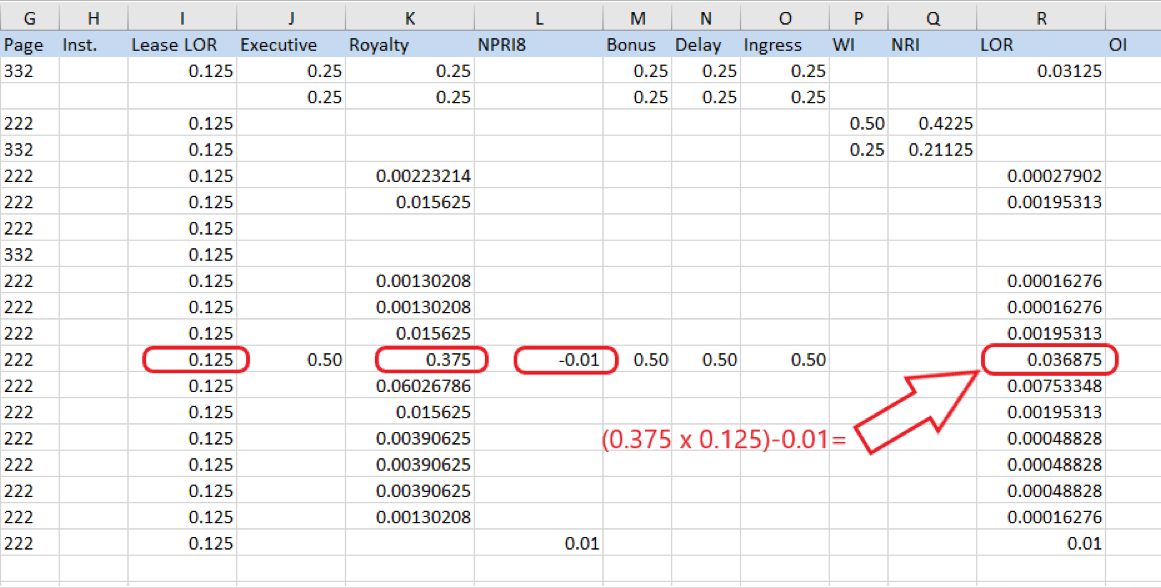

In this report, Column K represents royalty interests unburdened by any fixed NPRIs.

Column L represents the impact of fixed NPRIs.

In Column R, you’ll see that LOR is calculated by multiplying Royalty Interest by Lease Royalty Rates and then accounting for the fixed NPRIs.