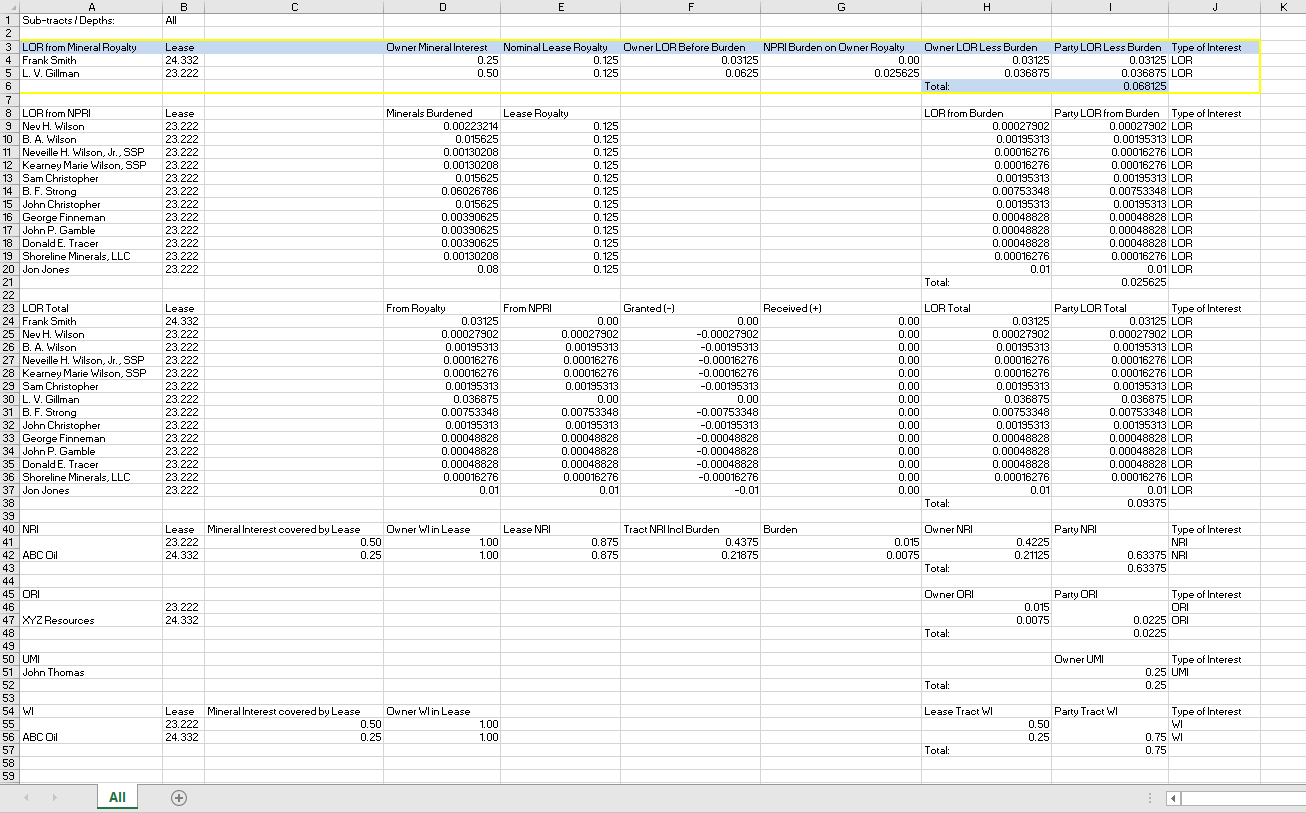

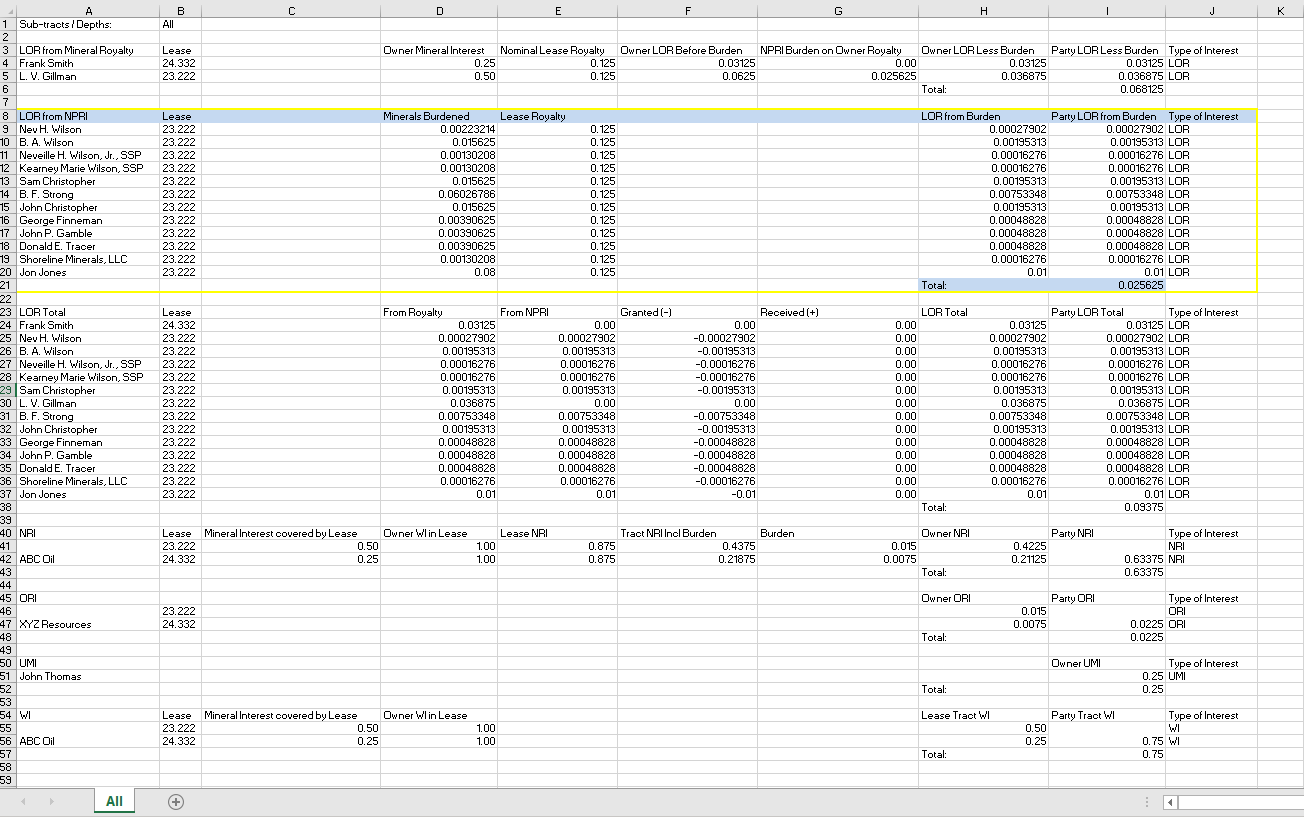

The Tracts Ownership Report includes a tab for each sub-tract within the AOI.

-

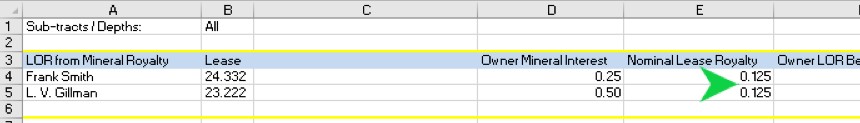

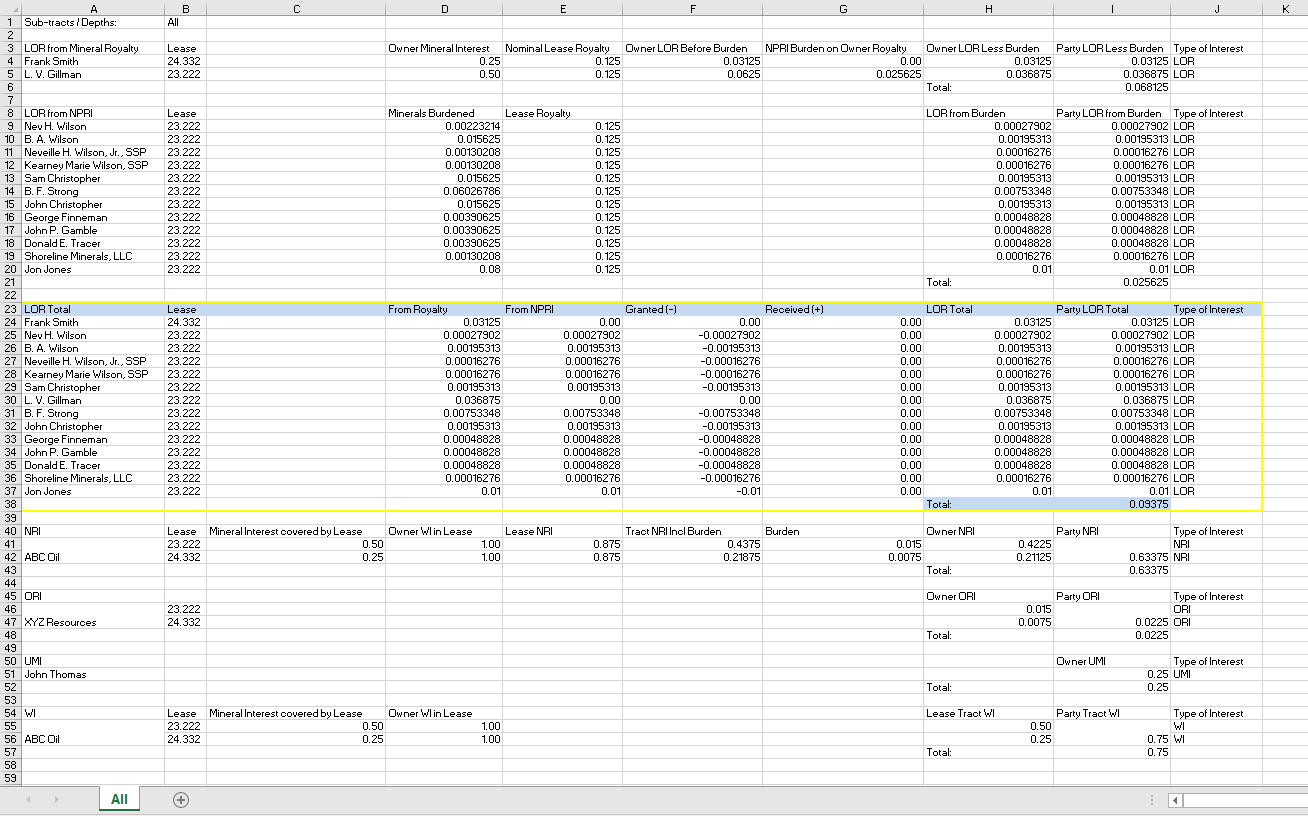

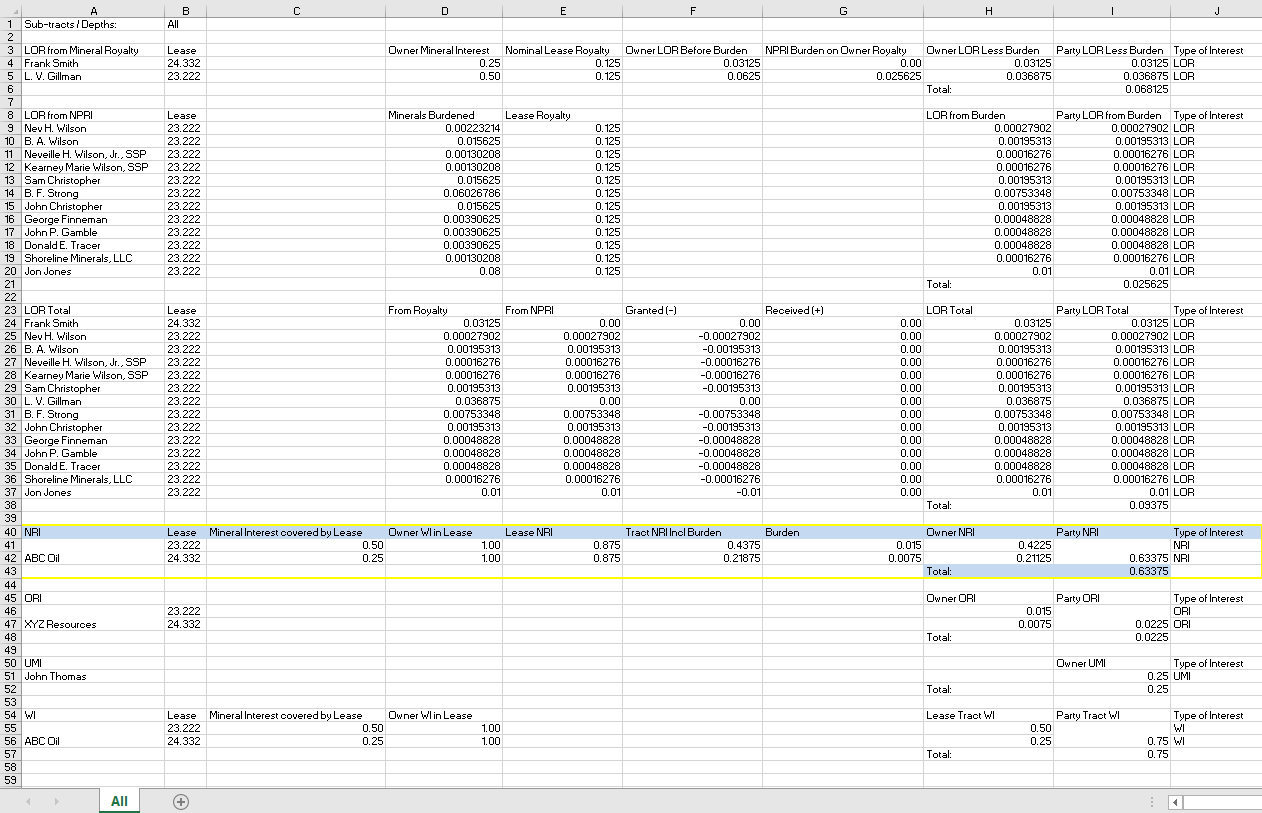

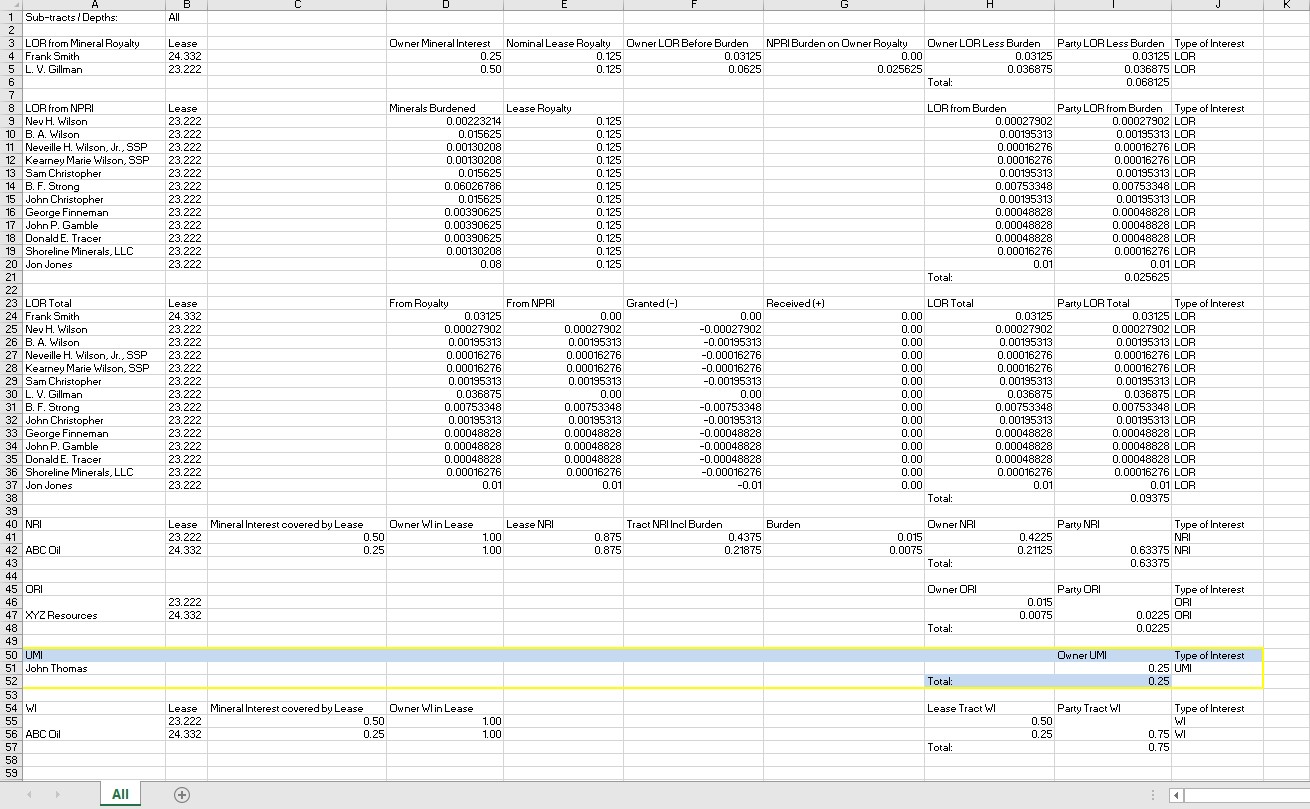

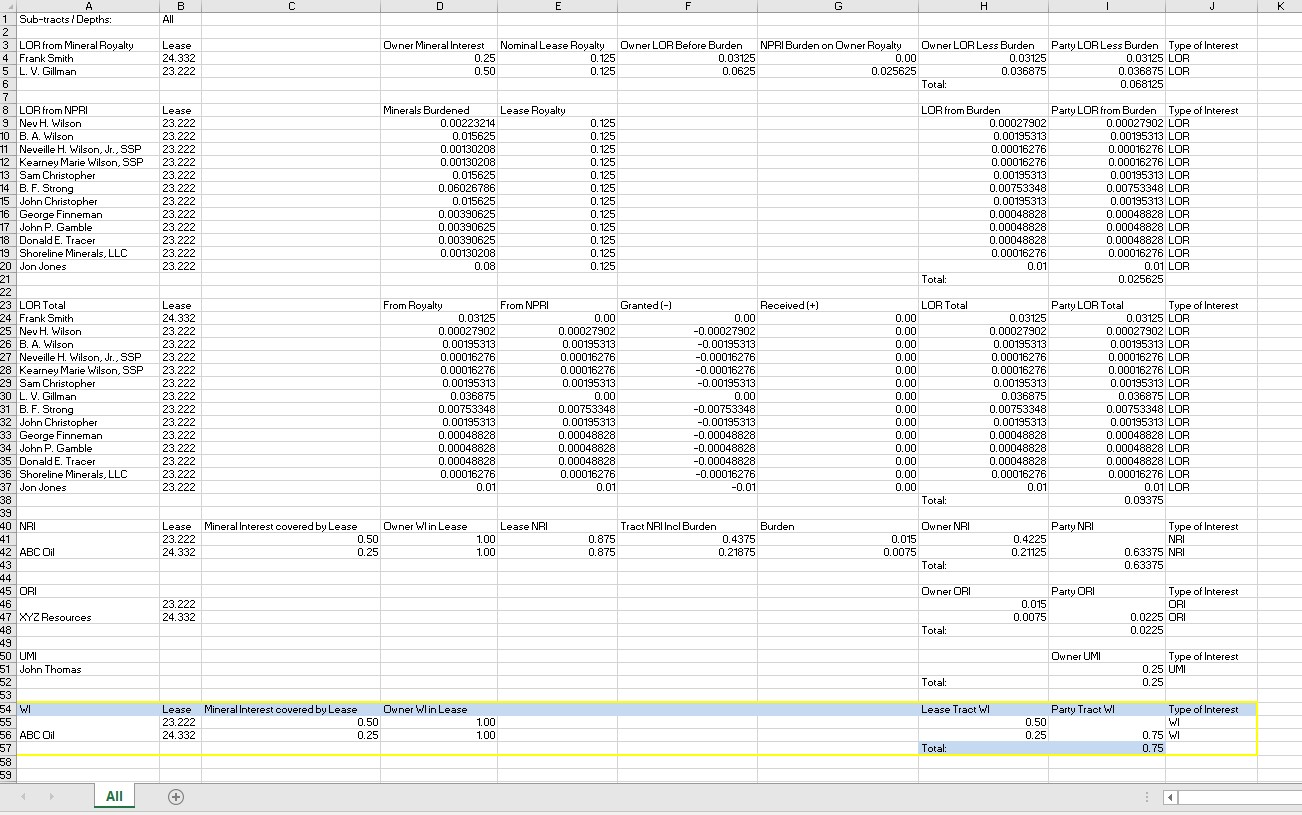

In the example below, the entire AOI is a single section, so we only have 1 Ownership Report tab.

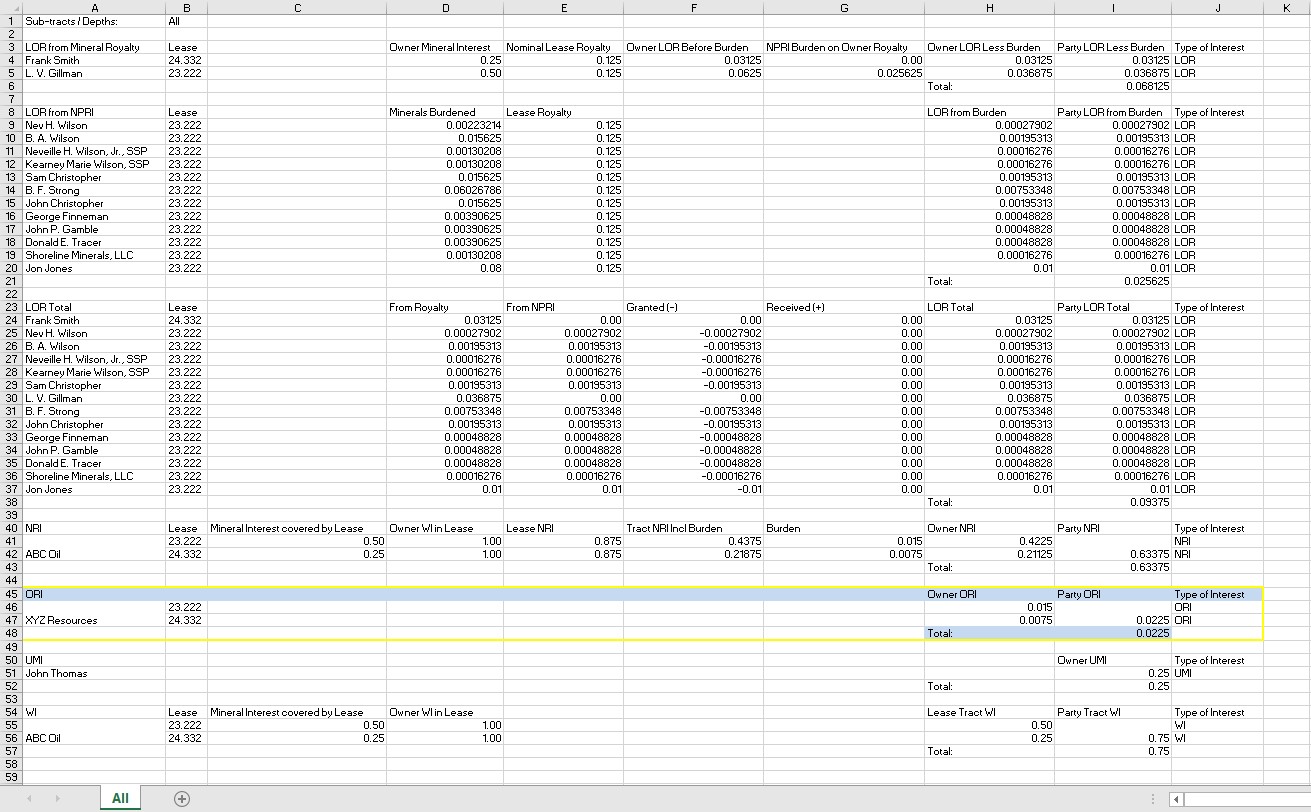

Each tab of the Ownership Report includes 7 sections, as follows:

LOR from Mineral Royalty; LOR from NPRI; LOR Total; NRI; ORI; UMI; WI

The following article will analyze each of these 7 sections, using an example AOI which is available upon request. Email [email protected] for access to that AOI.

Click here for a copy of the Ownership Report.

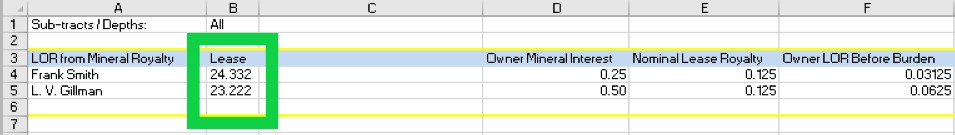

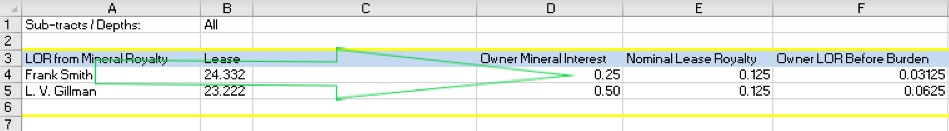

1. LOR from Mineral Royalty

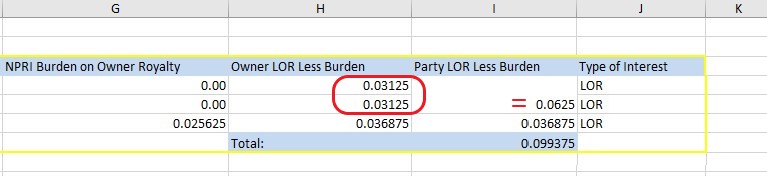

This section is highlighted below within the full Ownership Report tab.

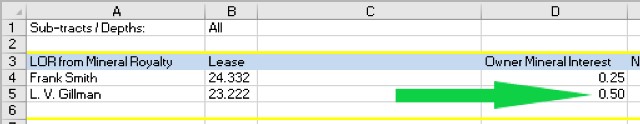

In this example, we have two leases.

The best practice is to name leases by their book and page or instrument number.

Regardless of whether Frank Smith was the original Lessor of OGL 24.332, Column D tells us that Frank Smith is now the owner of a 25% mineral interest covered by that lease.

Also, because it does not appear anyone else owns a portion of the mineral interest covered by that lease, we can conclude that OGL 24.332 covers 25% of the mineral interest.

Each of the leases in this example reserves a 1/8 royalty to the Lessor, as seen in Column E.

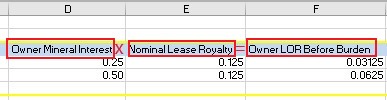

Column F shows us the Lessor Royalty owned by Frank Smith prior to any carveout of Burdens from NPRIs.

More simply, Column F shows the product of the mineral interest (Column D) and the royalty rate on the lease (Column E).

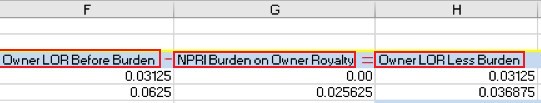

Column G shows us any NPRIs burdening an owner’s Lessor Royalty.

Column H shows us the owner’s Lessor Royalty after subtracting the burdens.

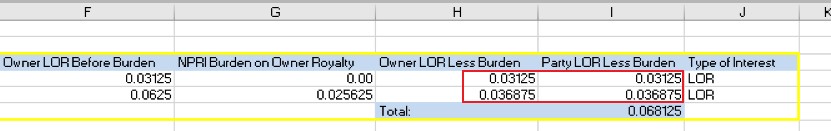

Column I shows us the total Lessor Royalty for each owner, as a sum of any leased interest owned.

In this report, each LOR from Mineral Royalty owner only owns LOR from one lease. Therefore, Column H and Column I are the same numbers.

Sidenote:

In the scenario below, a single owner acquired a mineral interest that was covered by another lease.

In this scenario, there would be 2 rows for this owner–1 for each OGL, and Column I would include 1 merged cell, reflecting the sum of Column H for this owner.

The above-described function of Column I continues all the way down the Ownership Report–it is a sum of Column H for each owner.

Throughout the Ownership Report, you can think of Column H as your “Per Lease” column and Column I as your “Per Tract (from all leases)” Column.

*Keep in mind, as mentioned above, each tab of an Ownership Report covers a different tract within your AOI. When Column I gives a sum, it sums the party’s interest in the lands described in the tract covered by that tab (identified in cell B1, at the very top of the report).

Back to our current example:

OGL 23.222 covers 50% of the mineral interest.

In this case, Column G does show us a significant burden from NPRI.

Notice that the sum of Column G (NPRI Burden on Owner Royalty) is equal to the Total from the LOR from NPRI section of the report.

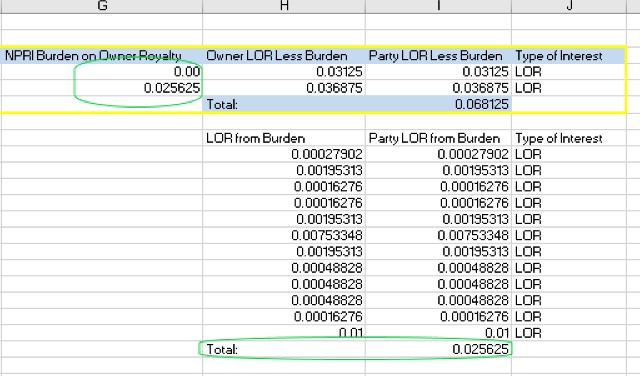

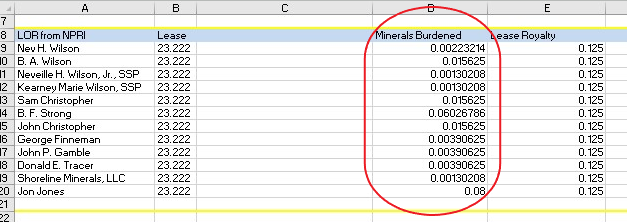

2. LOR From NPRI

This section of the Ownership Report tells us who owns Lessor Royalty from Non-Participating Royalty Interests.

It is highlighted below within the full Ownership Report tab.

Column D of the LOR from NPRI section of the report gives us an itemized list of minerals burdened by NPRIs.

The mineral interest covered by OGL 23.222 is burdened by a ⅛ floating NPRI (split among several owners)–an NPRI equal to ⅛ of the royalties payable on L. V. Gillman’s leased interest.

This lease is also burdened by fixed 1% NPRI, which is owned by Jon Jones.

Column D can also be viewed as the royalty interest owned by anyone other than the Executive Right owner.

Column E shows us the Lease Royalty Rate on the leases that cover the mineral interest burdened.

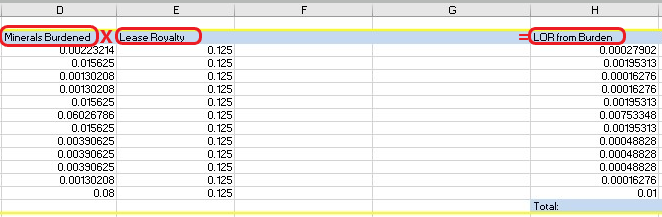

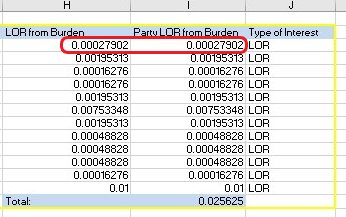

The LOR from Burden (Column H) is the product of the royalty interest (Column D) and the Lease Royalty Rate (Column E).

Again, Column H is our Per Lease column, and Column I is our Per Tract (from all leases) column.

In this case, each owner owns LOR from NPRI tied to the mineral interest covered by a single lease, so the numbers in Column H and Column I are the same.

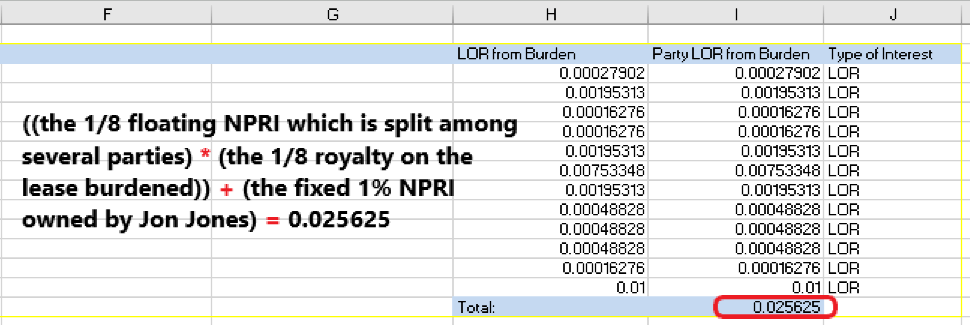

The floating 1/8 NPRI is divided among several owners above. As floating NPRIs, these are proportionately reduced by, in this case, a ⅛ lease royalty. The total burden from floating NPRIs is 1/64 or 0.015625.

The remaining 1% burden comes from the fixed 1% NPRI mentioned above. This is a flat 1% royalty from production that comes out of the royalty owned by the Lessor (or his successors). This interest is not proportionately reduced by any lease royalty rate.

In other words, the calculation for the Total LOR from NPRI is as follows:

If an NPRI burdened an unleased interest, it would not be reflected here. This is because that royalty would not currently be paid to anyone.

The NPRI would exist within Unleased Mineral Interest at the bottom of this report, but it would not be broken out in this report.

Instead, it would show up as Net Mineral Royalty Acres on the Flat Ownership report.

It is important to note that Tracts does not automatically assume any particular lease royalty rate in order to calculate Net Lease Royalty Acres.

If the interest burdened by a fixed NPRI were unleased, this burden would show up under the NPRI8 column of the Flat Ownership reports.

This interest would not show up as NMRA because you cannot calculate a fixed NPRI of 8/8 without it being leased.

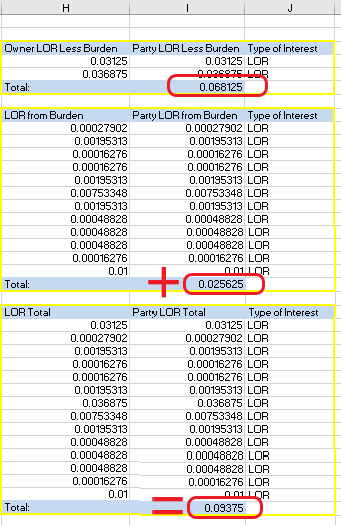

3. LOR Total

This section of the report provides the Lessor Royalty Total.

It is highlighted below within the full Ownership Report tab.

The LOR Total section of the ownership report is exactly what it sounds like.

It combines the first two sections to report the ownership of all Lessor Royalty in the tract.

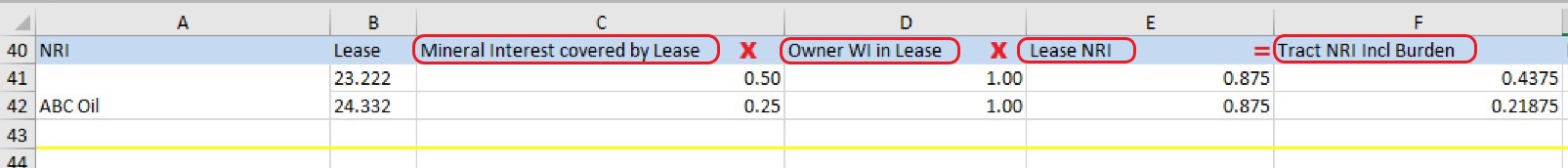

4. NRI

The Net Revenue Interest section of the ownership report reports lease revenues of working interest owners.

It is highlighted below within the full Ownership Report tab.

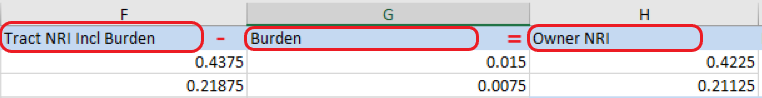

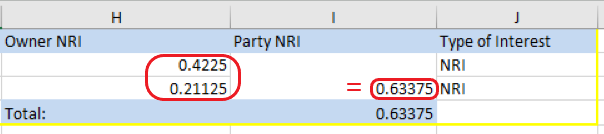

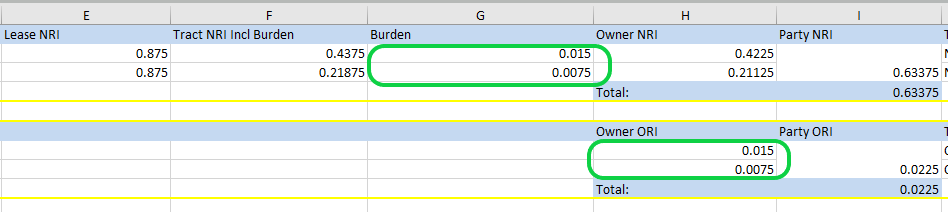

Column F is the Net Revenue Interest, prior to the carveout of any overriding royalty interest burdens. This can be calculated by multiplying Mineral Interest Covered by Lease (Column C) by Owner Working Interest in Lease (Column D) by Lease NRI (Column E).

Column G represents the overriding royalty interests.

Column H subtracts those overrides from the NRI.

Again, Column I is a sum of the interests the party (in this case, ABC Oil) owns in the tract from all leases.

5. ORI

This section of the Ownership Report analyzes Overriding Royalty Interests.

It is highlighted below within the full Ownership Report tab.

As stated above, ABC Oil was the Lessee on both leases. They assigned to XYZ Resources a 3% ORRI in and to all leases they owned, proportionately reduced by their WI in the tract.

OGL 23.222 covers 50% of the MI. Since ABC Oil owned 100% WI in that lease, they owned 50% in the tract. This means the proportionately reduced 3% ORRI would be a 1.5% ORRI from that lease.

OGL 24.332 covers 25% of the MI, and ABC Oil owned 100% WI. This gives them another 25% WI in the tract. So, the proportionately reduced 3% ORRI would be a .75% ORRI from that lease.

These burdens on the ABC Oil NRI are reflected both in Column G of the NRI section and in Column H of the ORI section.

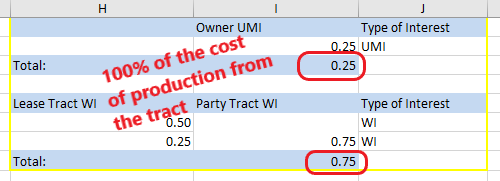

6. UMI

The Unleased Mineral Interest section shows us that 25% of the mineral interest is unleased and is owned by John Thomas.

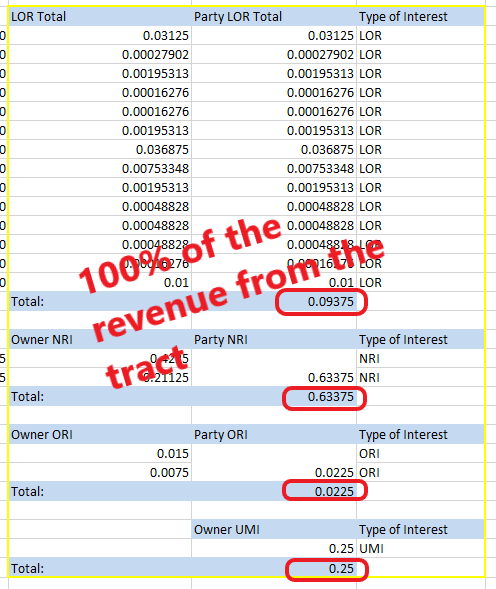

Note that, because the unleased mineral interest is also a revenue interest, this 25% UMI can be combined with total NRI, total LOR, and total ORI to equal 100%.

7. WI- Working Interest

The Working Interest section of the report shows us who is responsible for the costs of production on each lease and, in Column I, again, in the tract as a whole.

Note that, since UMI is also an obligation to pay for production costs, it can be combined with WI to equal 100% of the costs of production.