Initial Overview:

1. Verify that a Disclaimer has been attached and accurately covers dates searched.

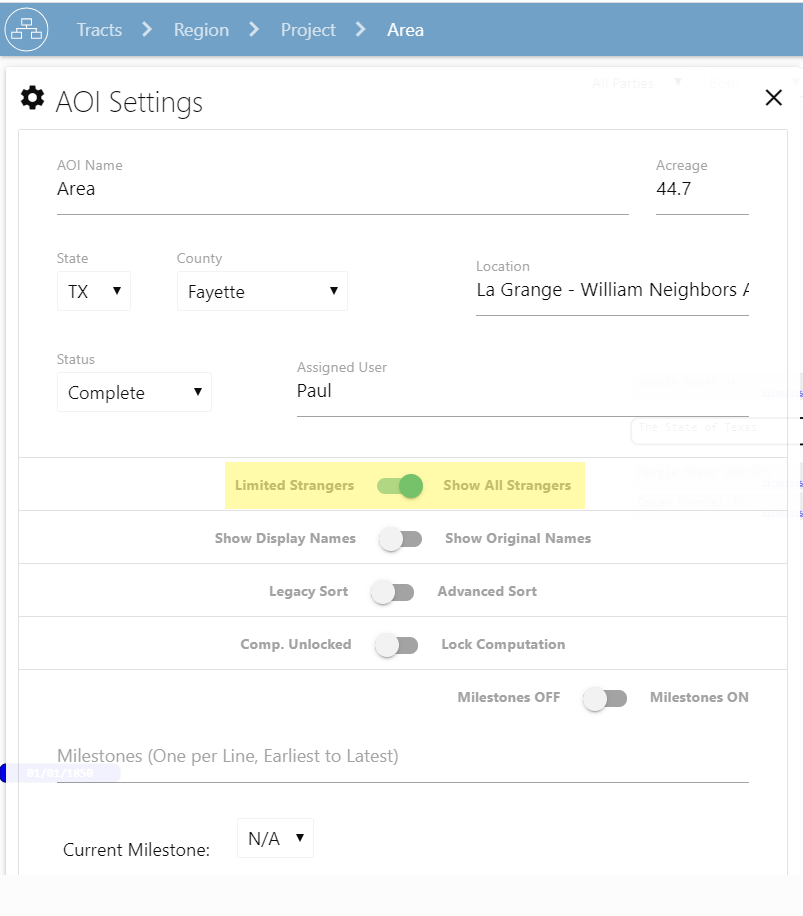

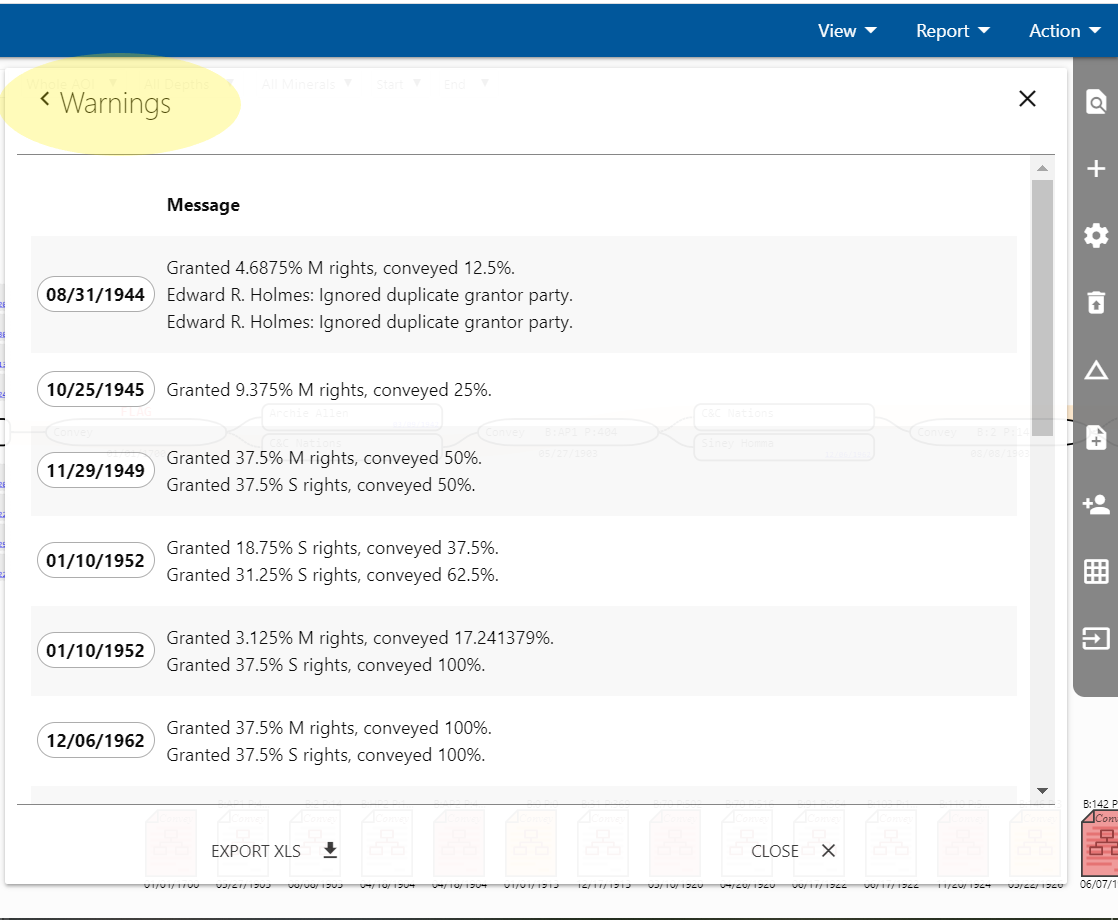

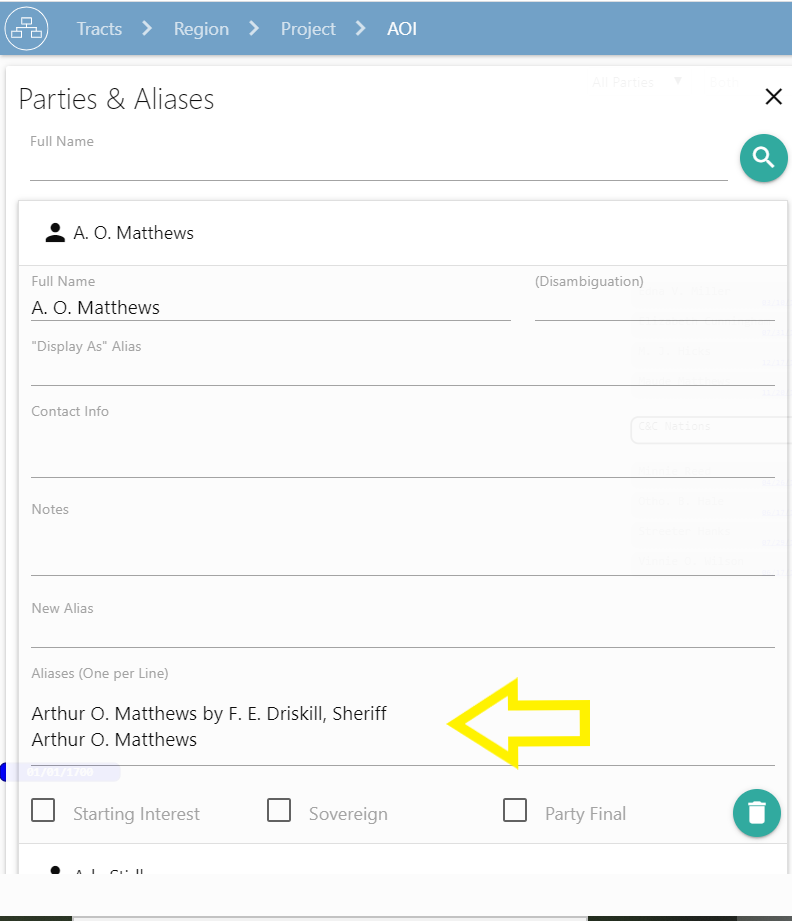

2. Go to Settings and toggle “show all strangers” and verify that they are legitimate strangers to title. If the same person or company is input again with a different name, this entity will be treated as a stranger unless and until an Alias is made. For example, Jane Doe may receive an interest, and Jane Doe may later get married and convey her interest as Jane Doe Smith. In this case, Jane Doe Smith will be treated as a stranger until Jane Doe is made into an Alias of Jane Doe Smith.

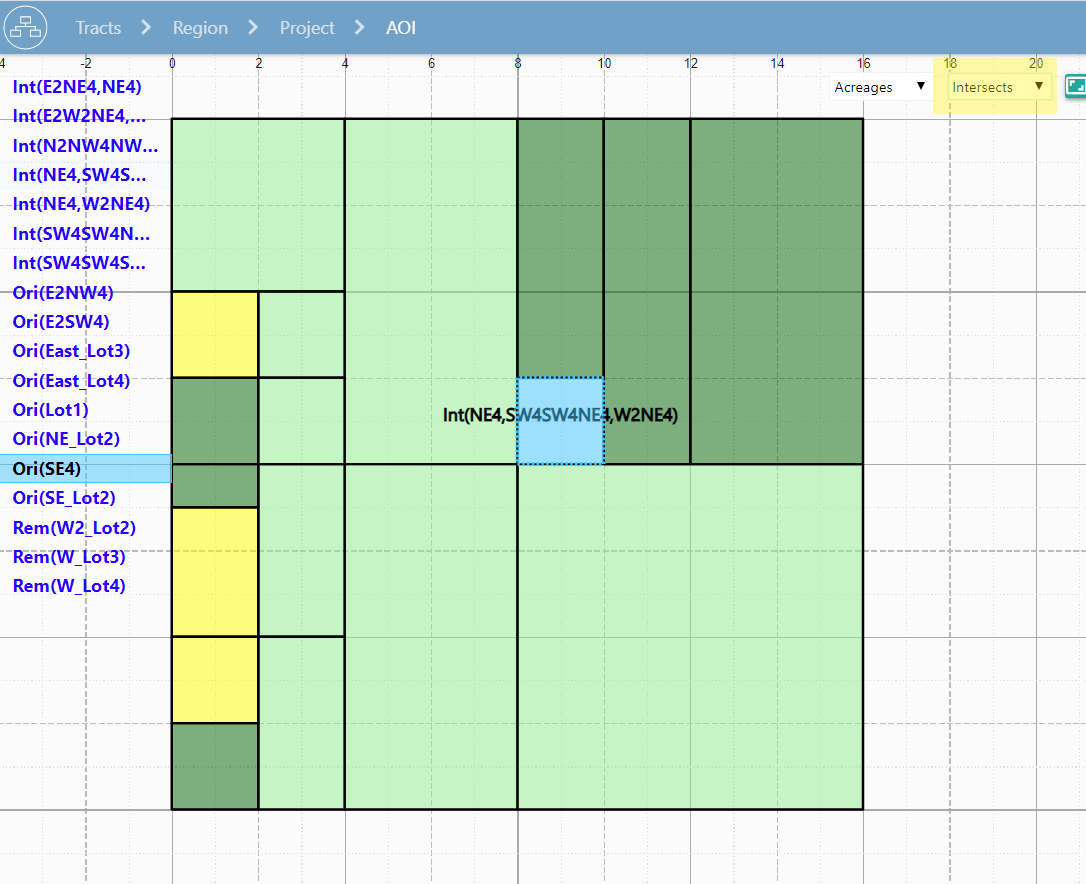

5. Open the Subtract/Grid Check that you have the proper subtracts, no accidental fragments of subtracts and that none say “constrained acreage.” A “constrained acreage” warning indicates that the acreage of the smaller subtracts within a larger subtract must be incorrect. For example, you cannot have two 10 acre subtracts within a larger, 15 acre subtract. Use the intersect tool to check this. Additionally, check for potential issues like undefined tracts, acreages, and depths.

Examination of Each Card

Conveyances

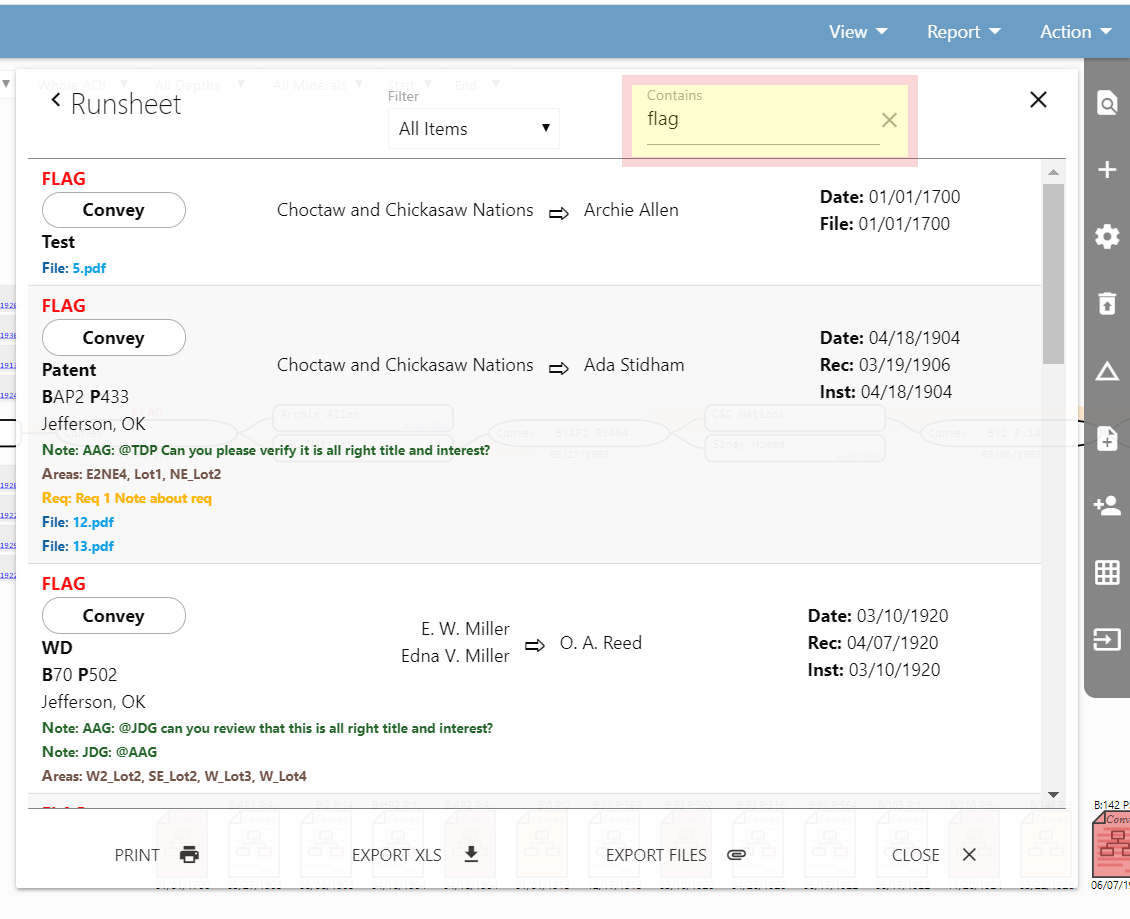

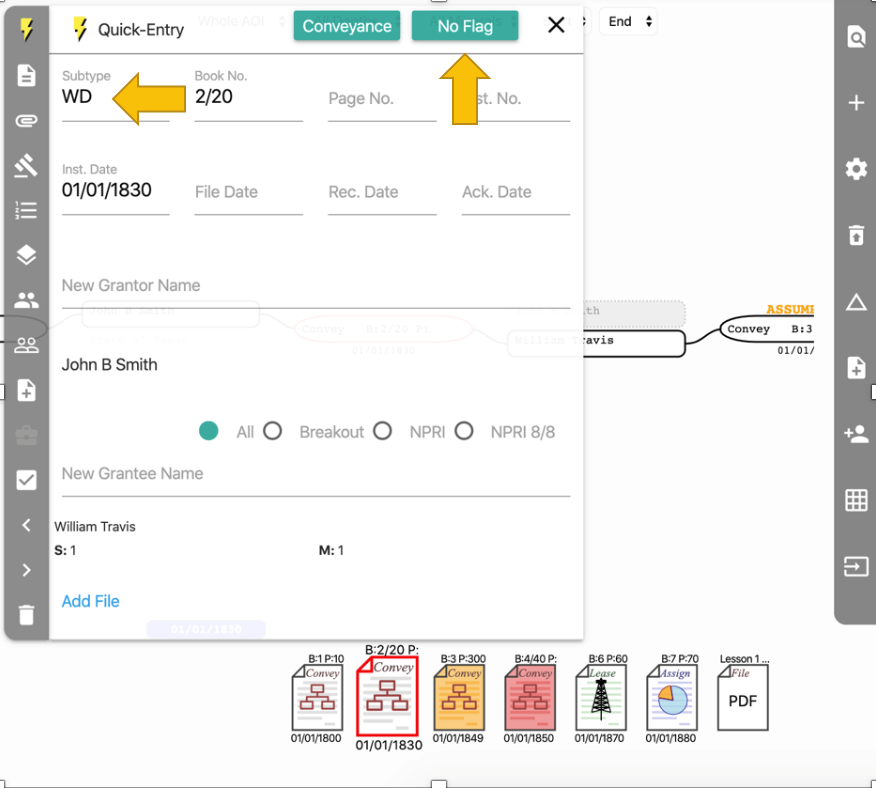

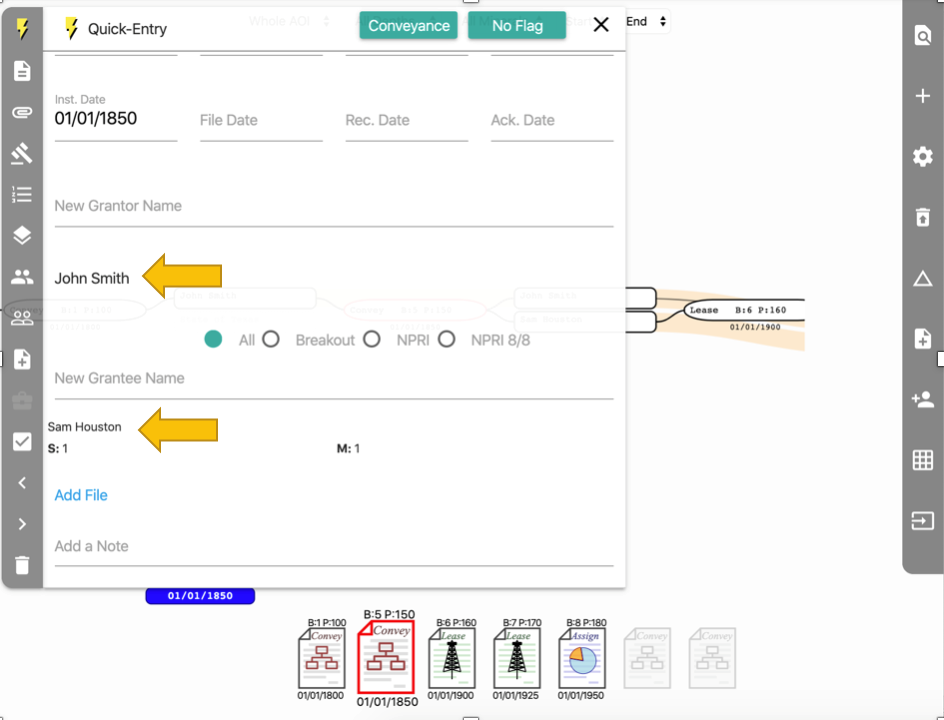

1. Open each card and the accompanying attached document(s). First, ensure that the abstractor has entered the appropriate document subtype (Warranty Deed, Quit Claim Deed, Special Warranty Deed, etc.). Also check whether the abstractor has appropriately flagged each card either “Flag”, “No Flag” or “Assumption”.

2. Ensure the grantor/grantee have been entered according to the project scope (husband and wife/JTWROS/Trusts etc.), if the Alias tool has been used, ensure it has been used correctly and does not conflate separate entities.

3. Ensure abstractor has selected the appropriate subtracts/depths as represented by the conveying instrument (if no subtract/depth is selected, tracts will by default convey all interest possessed by grantor. NOTE: it may be appropriate to NOT select subtracts where the instrument conveys all interest but does not give a specific description – this may occur in decrees, probates etc.).

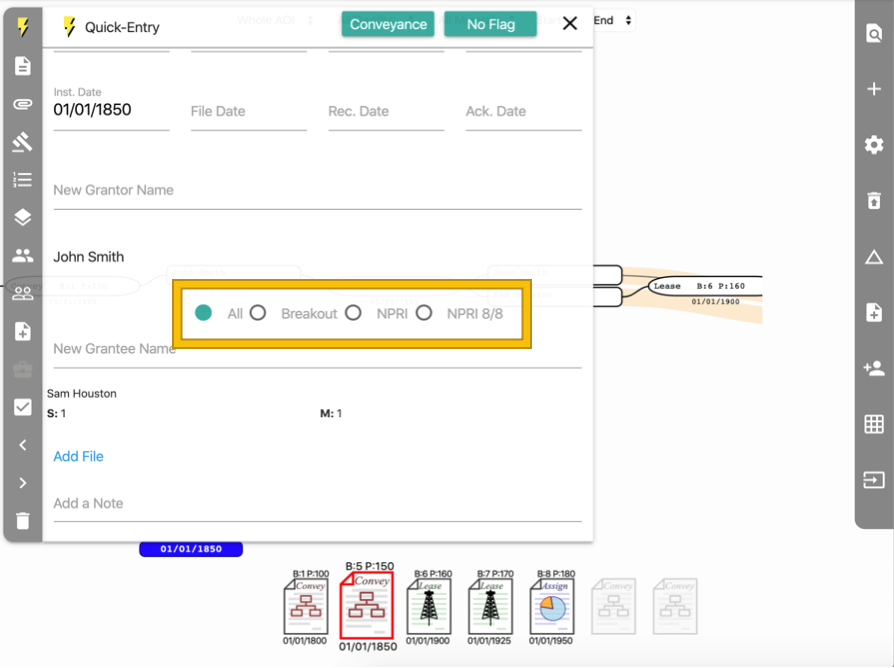

4. The Conveyance: Verify that the abstractor has interpreted the conveying language correctly.

- 8/8ths: The most common conveyancing error is misuse or nonuse of the “of interest” or “of 8/8ths” selection, this should be verified in each conveyance.

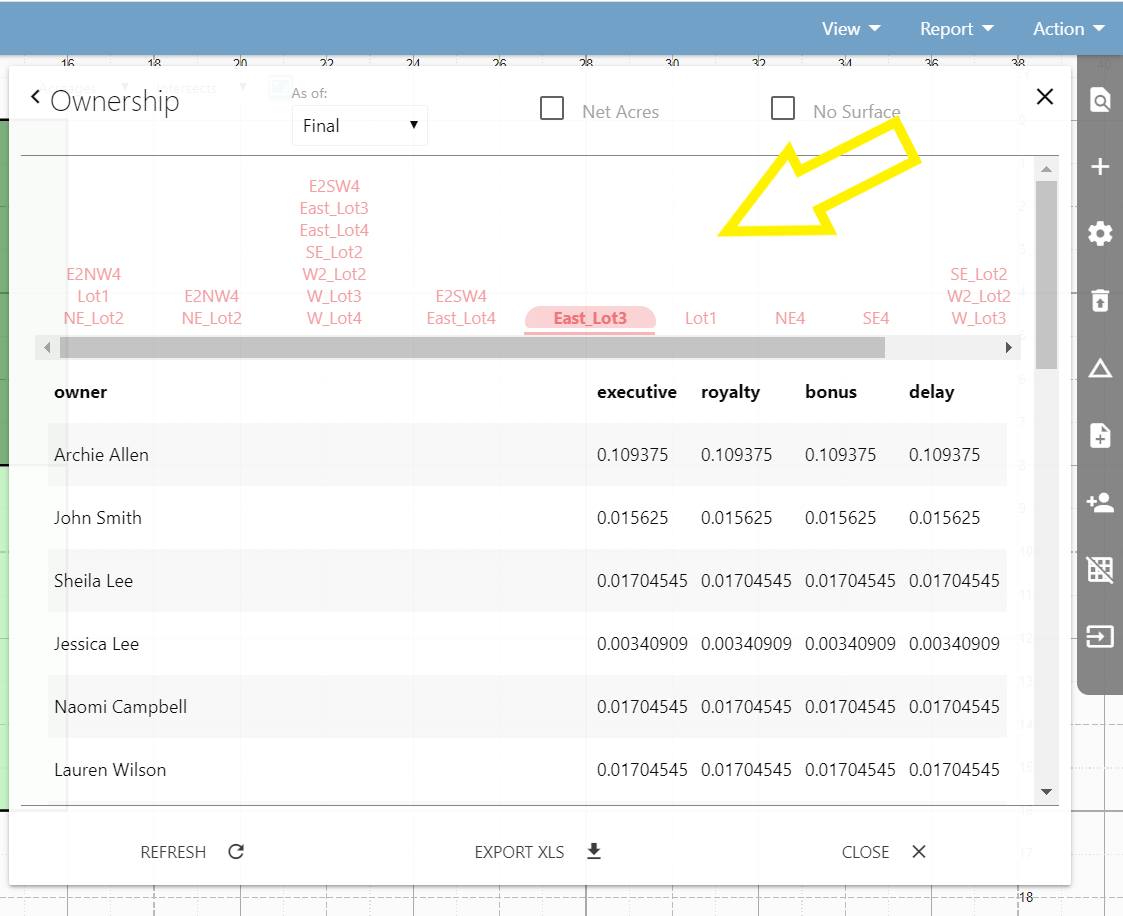

- Breakout: Ensure that the “Breakout tool” is used when appropriate, this will occur when mineral ownership has been reduced to its components – executive, bonus, delay, ingress/egress, royalty.

- Notes: If abstractor has used an uncommon method or formula to achieve a certain ownership result, a note may be necessary to explain the method.

- Best Practice: In instances where an abstractor achieves a “correct” ownership result but does so in a less effective manner, the conveyance may need to be corrected and the more effective manner communicated to the abstractor. i.e. Grantor has 50% interest, conveys an undivided 50% interest to grantee. If abstractor records this conveyance as a conveyance of 100% of interest, the resulting answer will be correct but less effective – the answer will only be correct where the grantor has 50% interest – if it was subsequently found that grantor at the time of the conveyance owned 75% the conveyance in this example would convey all 75% interest instead of the intended 50% of 8/8th.

- NPRI: In instances where an NPRI is either conveyed or reserved, ensure that the NPRI is represented correctly as either an 8/8ths or of Royalty NPRI

- Over conveyance/Duhig: If there is an over conveyance or duhig issue, ensure that the notecard has been appropriately noted.

- Community/Separate property: Ensure that any issues with community/separate property have been dealt with appropriately

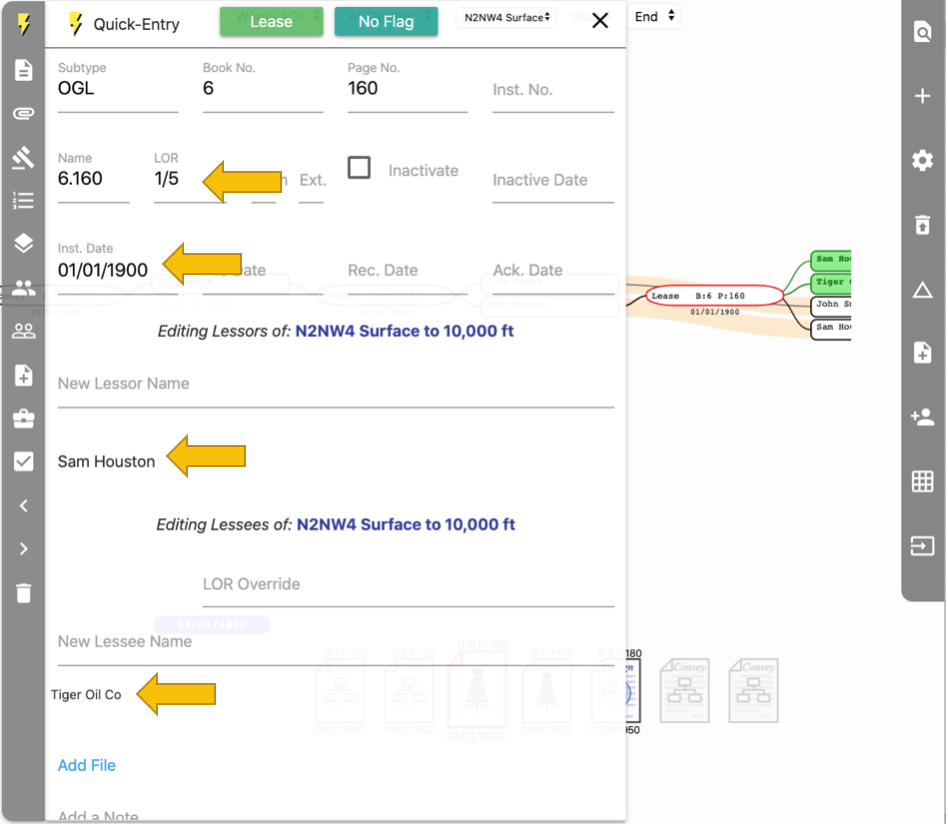

Leases

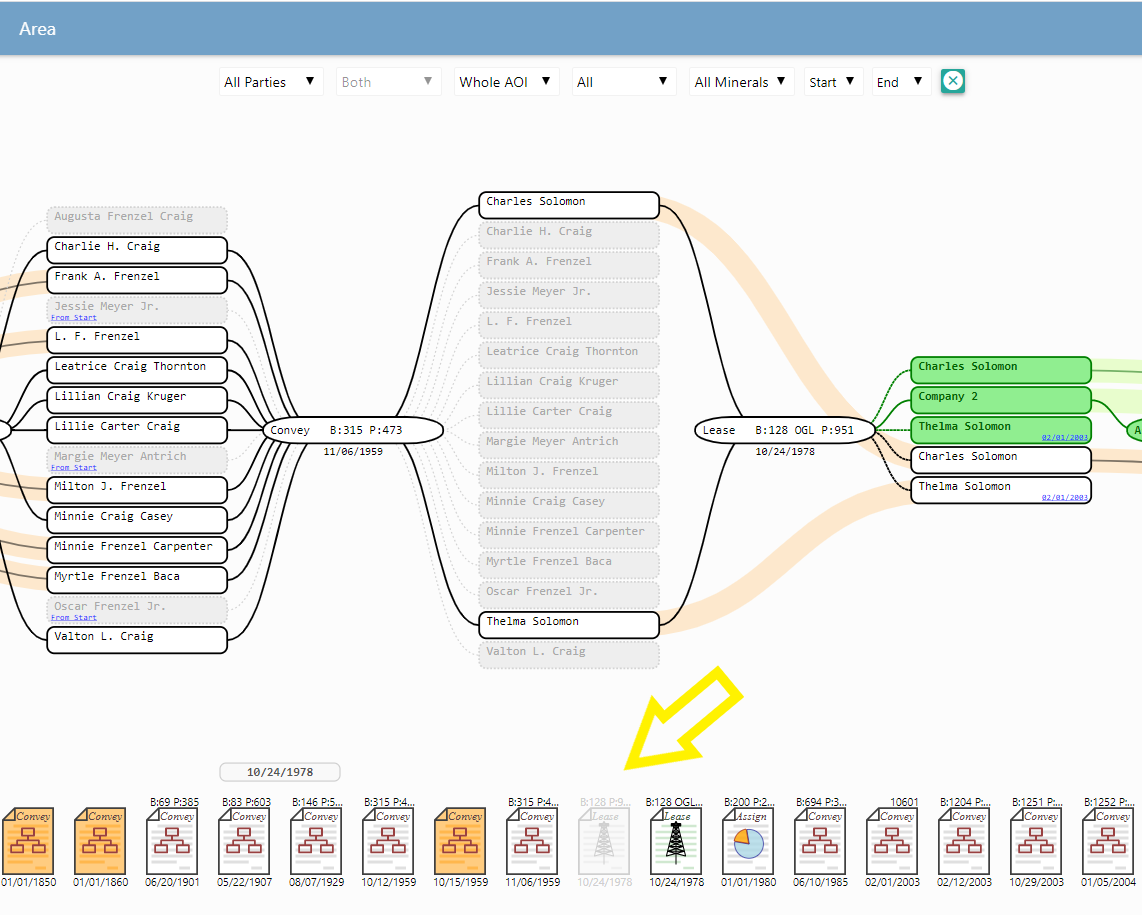

- Verify the Lessor/Lessee information is correct.

- Verify the lease effective date is correct.

- Verify the lease royalty term.

- Verify the lease subtracts have been entered correctly.

- Verify the lease extension.

- Note all lease terms as appropriate and as defined by project scope.

Assignments

-

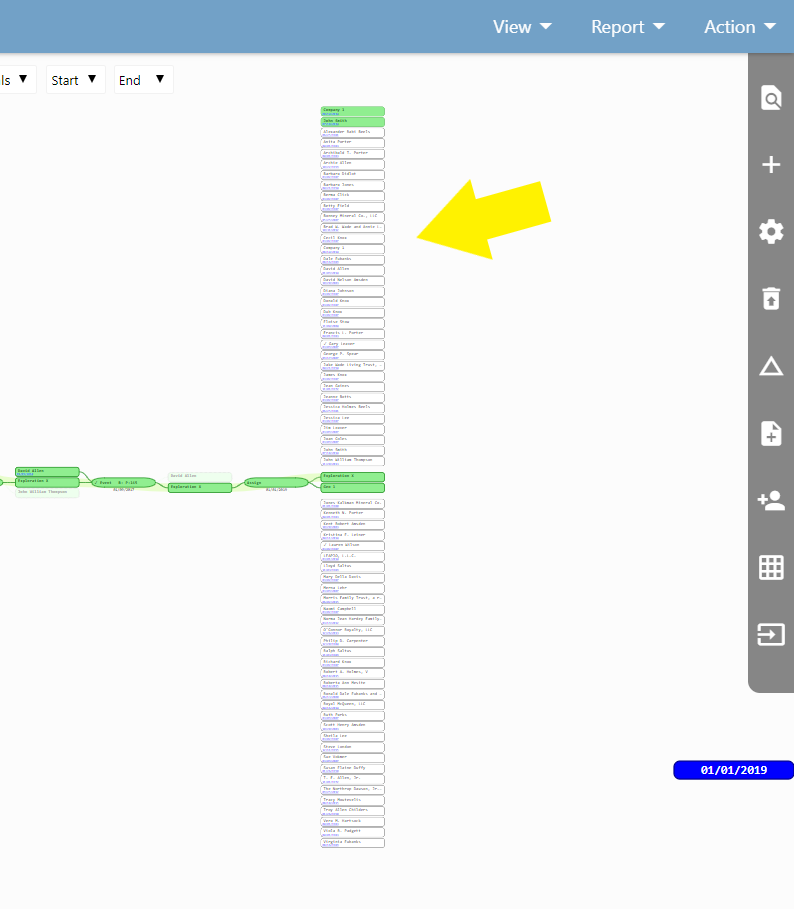

Verify the Assignor/Assignee’s information is accurate.

- Dates: Verify the effective date v. recording date v. executed date and ensure that the effective date is the operative date. If the effective date does not allow the assignment flow to chain correctly use the “superseding date” function in tracts and ensure a note has been provided

- Specific Lease: Ensure that the “specific lease” has been selected in every assignment. If a particular assignment assigns less than the entire lease selected, use the subtracts/depths tab to select the particular subtracts/depts to be acted upon

- Of interest/8/8ths: Ensure that interest has been entered as an “of interest” transaction. We should not be using the “8/8ths” conveyance when assigning working interest and net revenue interest. If you encounter an undivided leasehold assignment, the way to enter this into tracts will be as a function of the assignor’s WI. (x = (undivided interest referenced in assignment)/(Assignors Working Interest at time of Assignment). This function results in the true percentage of Assignor’s Working Interest that delivers the undivided WI referenced in the assignment.

As an example: Assignor owns 50% Working Interest prior to assignment. Assignor desires to assign an undivided 25% leasehold interest to assignee. x=25/50. x=½. 25% is ½ of the assignor’s interest at the time of this assignment and therefore ½ will be the fraction used for NRI and WI on your notecard with “of interest” on. If you toggled “of 8/8ths” and enter 25%, it will deliver a 25% NRI and WI. If you appropriately use ½ it will deliver 25% WI and the NRI that would take on 25% of burdens that the assignee is responsible for.

- Overrides: Ensure that if an override is reserved or assigned that the interest is conveyed/reserved as an 8/8ths interest, if appropriate and has been proportionately reduced if appropriate

Non-conveying Documents

- Ensure document type is correct.

- Check that all parties have been entered and that any notes appropriately detail any relevant instrument info.